President-elect Donald Trump has formally floated the idea of sending direct cash payments to Americans, funded by increased tariffs. However, economic advisors and fiscal analysts warn that significant legislative and financial hurdles remain before any checks can be issued.

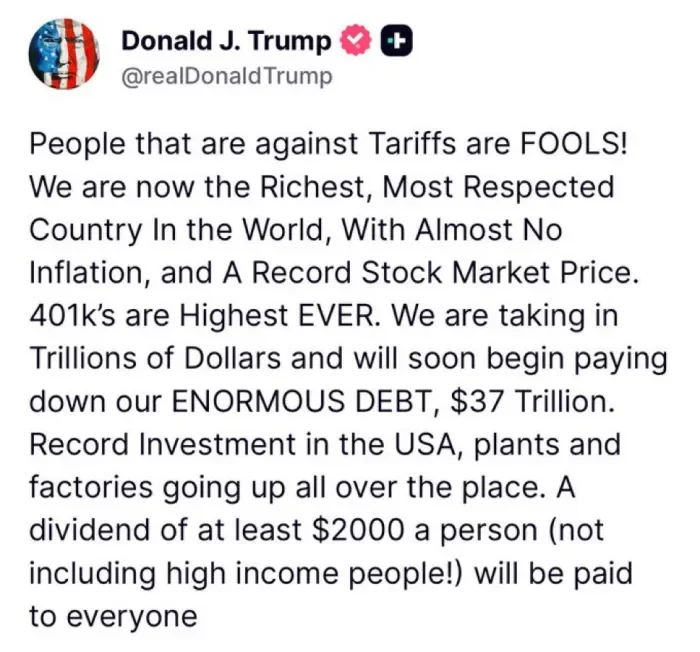

On November 9, President Trump took to Truth Social to announce a proposal that caught the attention of working-class voters nationwide. He outlined a plan to distribute a $2,000 “dividend” to Americans, excluding high-income earners. According to the President, this initiative would be funded entirely by revenue generated from heightened tariffs on foreign goods.

While the announcement signaled a commitment to utilizing the nation’s economic strength and booming markets for direct relief, the path from proposal to payment is complex.

The Role of Congress is Critical

Following the initial announcement, the administration moved to clarify the logistics of the proposal. On November 16, Scott Bessent, a key economic figure in Trump’s orbit, appeared on Fox News’ Sunday Morning Futures to provide further details.

Bessent confirmed that the administration is targeting “working families” for relief. However, he offered a crucial reality check regarding the timeline and execution. Unlike executive orders, fiscal spending of this magnitude requires legislative action.

“These payments could go out,” Bessent stated during the interview, “but only with congressional authorization.”

This statement underscores the constitutional reality that Congress holds the “power of the purse.” Lawmakers will be responsible for drafting the legislation, determining the specific income thresholds for eligibility, and deciding whether the payout takes the form of a direct check, a tax rebate, or a credit.

The Math: Costs vs. Revenue

While the political will may exist, fiscal analysts are scrutinizing the feasibility of funding such a large program exclusively through tariff revenue.

The nonpartisan Committee for a Responsible Federal Budget (CRFB) has released new estimates regarding the proposal. Their analysis suggests that if the rebate is structured similarly to the COVID-19 stimulus checks, the total cost could approach $600 billion.

This figure presents a significant math problem. According to current data, the United States collected approximately

Shifting Economic Priorities

The “tariff dividend” represents a pivot in the President’s economic messaging. Earlier this year, Trump signaled an openness to rebates but emphasized that his primary fiscal goal was paying down the national debt.

Recently, the conversation has expanded to include the Department of Government Efficiency (DOGE). The administration has suggested that cost-saving measures identified by DOGE—which claims the potential for hundreds of billions in spending cuts—could arguably create the fiscal space needed for these dividends.

Summary: What Needs to Happen Next?

For Americans hoping to receive a $2,000 check, the process is still in the early stages. The proposal must move through three distinct phases:

-

Formalization: The administration must present a concrete plan detailing funding and eligibility.

-

Legislation: Congress must debate, draft, and pass a bill authorizing the spending.

-

Implementation: The Treasury would then need to set up the distribution mechanism.

While the proposal is on the table, it remains a subject of debate between the administration’s vision and the hard realities of federal budgeting.